30+ Front end debt to income ratio

Find the DTI ratio for your rent or mortgage loans and credit cards. The front end debt-to-income ratio is a calculation that takes the monthly gross income divided by the mortgage payment including taxes insurance mortgage insurance fee and any other.

Public Service Loan Forgiveness 40 Tips To Save Thousands

Calculate your debt-to-income ratio using our simple calculator.

. Expressed as a percentage a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income. You can add 1125 to the income side and must add 1000 to the. To illustrate suppose you own a rental property with monthly expenses of 1000 and average rent of 1500.

Your Debt-to-Income DTI Ratio is 2889. On the off chance that a homeowner. Lenders generally look for the ideal front-end ratio to be no more than 28 percent and the back-end ratio including all monthly debts to be no higher than 36 percent.

Today the debt ratio requirements for an FHA. This debt-to-income ratio calculator is designed to help you understand what you need to do in order to qualify and close on a mortgage loan. Lenders consider two types of debt-to-income ratios during the mortgage process.

The back-end DTI ratio shows the income percentage covering all your monthly debts. To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments child support. Your Credit Risk Level is Moderate Back-End Front-End Debt-to-Income Ratio.

It is calculated by adding up your total monthly bills such as your credit card debt payments. Lenders always prefer borrowers with a lower debt-to-income ratio. The front-end debt-to-income DTI ratio is a variety of the DTI that computes the amount of an individuals gross income is going toward housing costs.

Lenders prefer to see a debt-to-income ratio. The lender must document the additional debt s and reduced income in accordance with B3-6-01 General Information on Liabilities or B3-3 Income.

Public Service Loan Forgiveness 40 Tips To Save Thousands

/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

Best Mortgage Calculator Osama Emara Mortgage Loan Originator

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Loan Data Analysis Gabe Mednick

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

If Someone Took The Us Debt To Income Ratio And Made A Percentage Comparison To A Household Budget Of 80 000 What Would The Numbers Be Quora

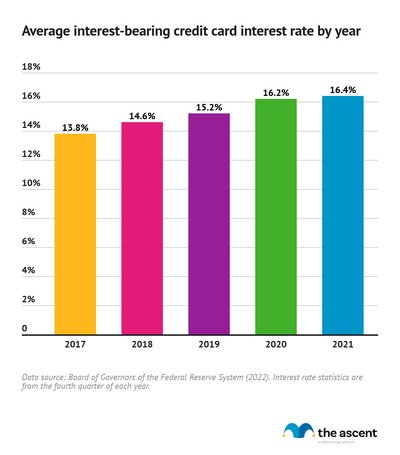

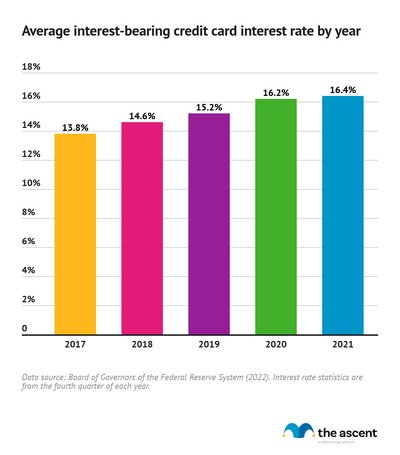

Credit Card Debt Statistics For 2022 The Ascent

Apollo Global Management Inc 2021 Current Report 8 K

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

When Banks Evaluate My Debt To Income Ratio Is Income Accounted For The Gross Revenue I Bring In From Work Or Net Income After All My Living Expenses Quora

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans

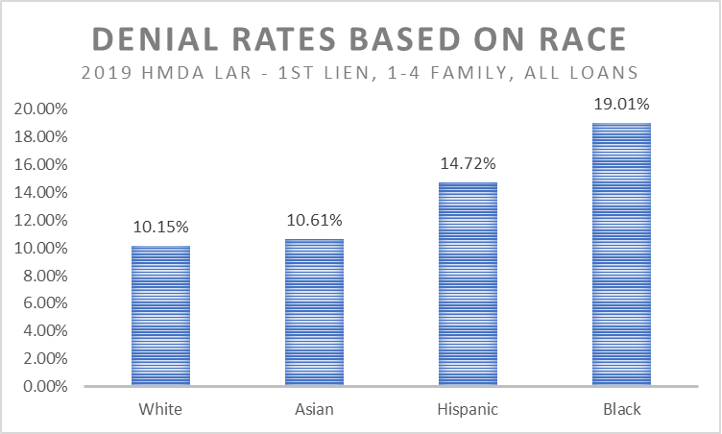

Using Special Purpose Credit Programs To Expand Equality Nfha

What Bills Are Calculated In The Debt To Income Ratio Quora